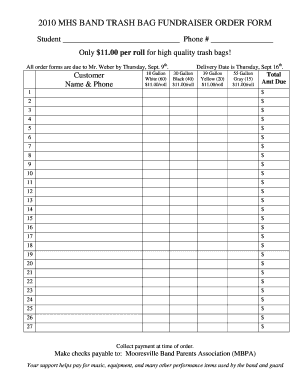

Fundraising for Small Groups Newsletter Can You free printable template

Show details

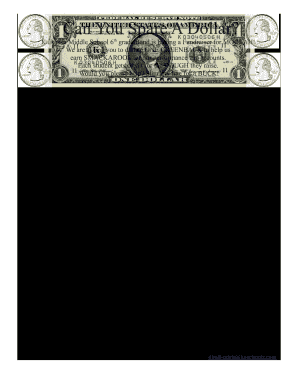

Can You Spare a Dollar The Name of Your Group Here is having a dollar fundraiser. We need your help to reason for the fundraiser. Would you please help and sign any line for a dollar 1. I will start you off* 2. I m happy to give you a dollar. 3. A dollar won t break me. 4. A dollar is not very much. 5. I just can t say no. 6. Well since it s you. 7. What s a dollar between friends 8. I ll gladly give you a dollar 9. My dollar is for a good cause. 10. My dollar helps reach the goal* 11. I wish...

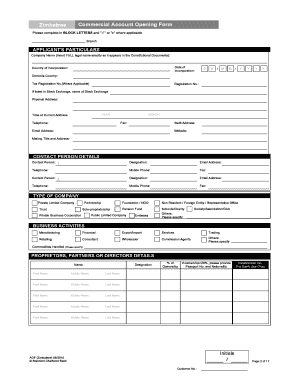

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fundraiser sheet template form

Edit your can you spare a dollar fundraiser sheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your printable fundraiser sheets template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fundraising forms online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fundraiser guidelines form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out can you spare a dollar form

How to fill out Fundraising for Small Groups Newsletter Can You Spare

01

Open the Fundraising for Small Groups Newsletter template.

02

Add the name of your small group at the top of the newsletter.

03

Include the date and a brief introduction explaining the purpose of the fundraising.

04

Create a list of fundraising goals and specific items or activities you are raising funds for.

05

Provide details about how the funds will be used and the impact they will have.

06

Include ways for people to donate, such as links to online payment platforms or instructions for sending checks.

07

Mention any deadlines for donations to create urgency.

08

Add contact information for questions or further inquiries.

09

Include a thank-you note for potential donors and supporters.

Who needs Fundraising for Small Groups Newsletter Can You Spare?

01

Small community organizations looking to raise funds for specific projects.

02

Church groups or religious organizations organizing events.

03

Local clubs or sports teams aiming to finance equipment or activities.

04

Non-profit groups seeking donations for charitable causes.

Fill

fundraising form pdf

: Try Risk Free

People Also Ask about can you spare a dollar

How do I deduct church tithing from my taxes?

In most years, the donations you make to your church throughout the year can be deducted from your taxes only if you itemize your expenses on Schedule A when you file your personal tax return. Most taxpayers use Schedule A, when their total itemized deductions exceed the standard deduction for their filing status.

What are you supposed to donate to church?

A tithe is 10%. But Christians under New Testament law are not bound to Old Testament law. So give as much as you'd like, even far and beyond a tithe! Give your money, give your time, give your heart.

How much can you write off for church donations?

There are some limitations on how much your congregants can claim on their taxes. Total church giving plus any additional charitable contributions can't exceed 60% of someone's adjusted gross income for the year. In cases where it does, that person can't deduct all of their donations for the current tax year.

What is a donor sheet?

A donation form is a key tool you use to collect information and process a donation. This encompasses both the physical form that a supporter fills out and the form on your online donation page. When creating a donation form, you have to consider the giving experience.

What is the tax deduction form for church tithes?

Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500.

How do you record a journal entry for donations?

For a business, create an invoice to the charity for the products or services that were donated. To record the expense, set up an expense account for donations. Next, create an entry in your accounting system that represents the product or service that was donated. You can define this as "charitable contribution."

What do you write when making a donation?

'A Donation Has Been Made in Your Name' Wording for a Card 'A donation has been made in your name to X Charity. 'As a gesture of goodwill, I made a donation in your name to X Charity. 'To honor your love and support, I made a donation in your honor to X Charity. 'A heartfelt donation was made in your honor to X Charity.

How do you record in kind donations at church?

The accepted way to record in-kind donations is to set up a separate revenue account but the expense side of the transaction should be recorded in its functional expense account. For example, revenue would be recorded as Gifts In-Kind – Services, and the expense would be recorded as Professional Services.

How do you ask for donations to church?

Requesting Donations A church donation request letter is a letter sent to church members or other potential donors, asking for their financial support. The letter should explain the need for donations and how the money will be used. It should also include a call to action, asking the reader to make a donation.

How do you record donated items?

When you make a donation of your own products or inventory, keep in mind that you are giving away a product, not selling it. To record this type of donation, debit your Donation account and credit your Purchases account for the original cost of goods.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit donation sheet from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your fundraising sheet template into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for the donation sheets for fundraising in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your donation sheet for fundraising in seconds.

How can I edit fundraiser form on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing fundraiser papers.

What is Fundraising for Small Groups Newsletter Can You Spare?

Fundraising for Small Groups Newsletter Can You Spare is an initiative designed to help small groups raise money for their activities, projects, or community services by providing them with tips, resources, and strategies for effective fundraising.

Who is required to file Fundraising for Small Groups Newsletter Can You Spare?

Small groups, organizations, or clubs that engage in fundraising activities with the intention of raising funds for specific projects or needs may be required to file the Fundraising for Small Groups Newsletter Can You Spare.

How to fill out Fundraising for Small Groups Newsletter Can You Spare?

To fill out the Fundraising for Small Groups Newsletter Can You Spare, groups should provide details about their fundraising goals, proposed events, target audiences, budget estimations, and any past fundraising successes or challenges to demonstrate their planning and strategies.

What is the purpose of Fundraising for Small Groups Newsletter Can You Spare?

The purpose of the Fundraising for Small Groups Newsletter Can You Spare is to encourage and support small groups in their fundraising efforts, providing them with guidelines and resources to successfully engage their communities and raise necessary funds.

What information must be reported on Fundraising for Small Groups Newsletter Can You Spare?

The information that must be reported includes the group's mission, specific goals for the fundraising campaign, estimated budgets, planned events or activities, potential sources of funding, and expected outcomes from the funds raised.

Fill out your Fundraising for Small Groups Newsletter Can You online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fundraiser Donation Sheet Form is not the form you're looking for?Search for another form here.

Keywords relevant to printable dollar fundraiser sheet form

Related to fundraiser sheet

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.